FOMC members are showing increasing disagreement on the projected path of monetary policy. Table 1 demonstrates the distribution of opinions of the Feed members by their hawkishness.

|

Date |

Hawkishness [-2 = dovish / 0 = neutral / 2 = hawkish] |

||||

|---|---|---|---|---|---|

|

-2 |

-1 |

0 |

1 |

2 |

|

|

1/14/22 |

1 |

2 |

5 |

5 |

1 |

|

2/10/22 |

0 |

3 |

6 |

5 |

1 |

|

4/20/22 |

1 |

4 |

6 |

4 |

1 |

|

5/12/22 |

1 |

4 |

7 |

4 |

0 |

|

7/14/22 |

1 |

4 |

8 |

4 |

1 |

|

10/18/22 |

0 |

2 |

9 |

6 |

1 |

|

1/11/23 |

1 |

3 |

7 |

5 |

2 |

|

5/31/23 |

2 |

4 |

5 |

4 |

3 |

Table 1. Fed spectrometer, 2022-2023

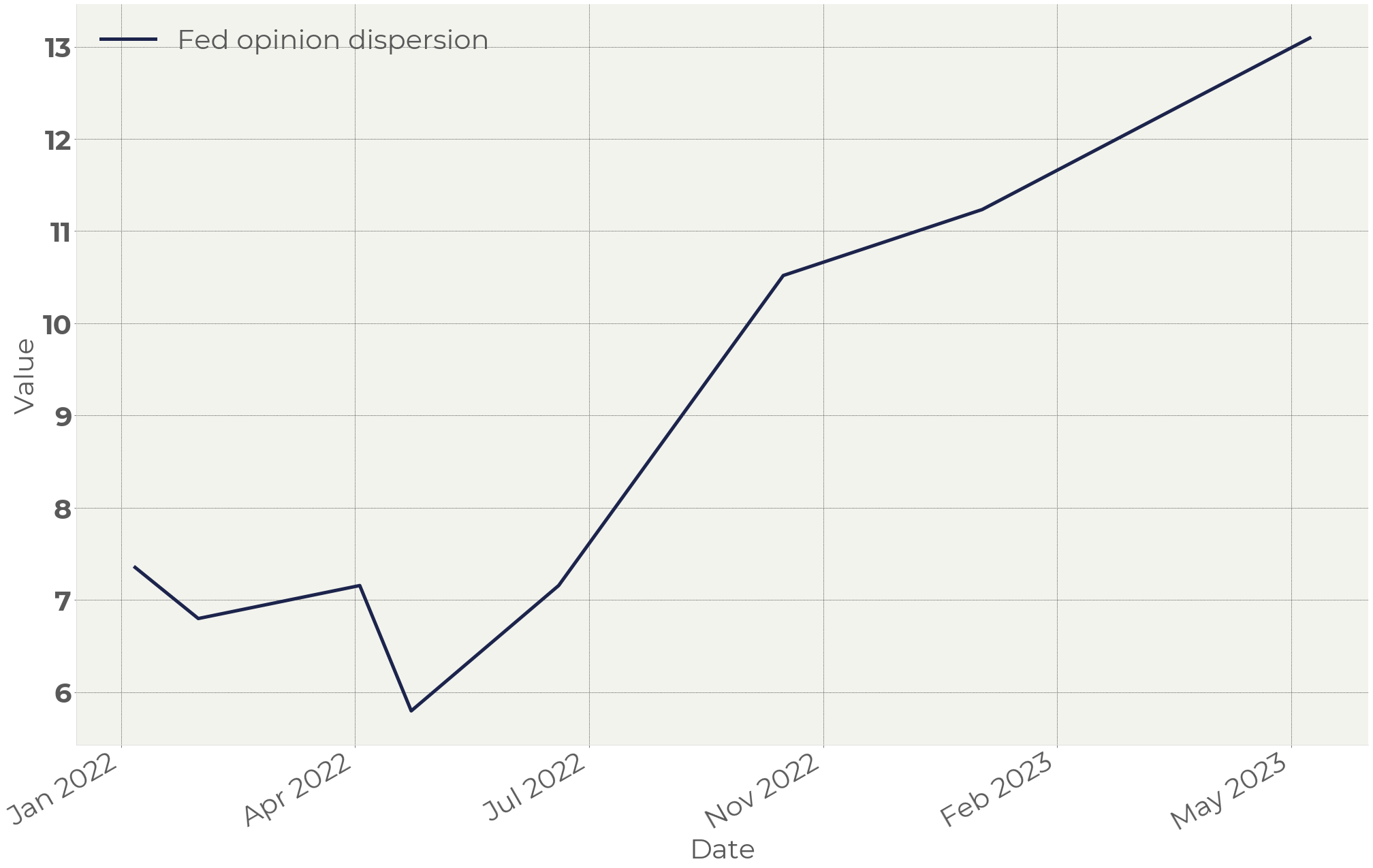

Figure 1. FOMC members opinion dispersion (Federal Reserve, Bloomberg, Panthea calculations)

On Figure 1 we present the behavior of the dispersion of the FOMC members opinions.

In our view, there are two major approaches investors can take now to the economy and the markets.

First, which is likely to be a basic one for now, is based on an assumption that the current state of the economy is a derivative of the Fed rate. For those supporting this view the current rate level has led to a moderate fall in the labor market vacancies and inflation and did not harm the economy severely. Hence, to accelerate the normalization of the economy, extra rate hikes are needed. The recent surge in car and home sales is backing this assumption.

The second approach relies on the fact that the current economic activity is a result of already printed money. The monetary surplus is quickly reducing, so the economy is going to feel the rate level when the monetary surplus evaporates.

We suppose the risk of the second scenario is rising. Indeed, high rates can keep household from new borrowings (and they do) but cannot prevent them from spending what they already have. In other words, the sensitivity of the economy to rates is low as long as there is an excess of money. Rising rates in this case will not provide a quick reaction. However, after the extra money dissolves, the economy is going to face scarcity of money. The higher the key rate will be at that moment the more shocking stress will happen.

By far we do not see enough economic data supporting one or another point of view. We suppose, however, that such a disagreement in the Fed is a risk by itself.