The vacancies rate a.k.a. JOLTS Job Openings rate [1] (the ‘vacancies’) has the lowest possible rating of popularity in Bloomberg. The recent reding for September was a negative surprise for investors. In this review we are highlighting why this statistic deserves more attention and why the upcoming statistics which is about to come out on the 30 th of November can be a positive surprise.

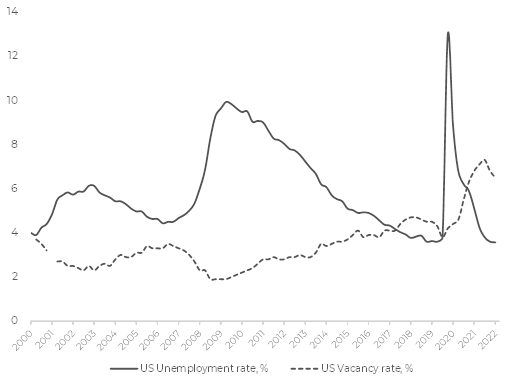

The unemployment and the vacancies rates are related in an obvious way: the more open vacancies an economy has the lower the unemployment is (Figure 1). The unemployment is calculated by the Bureau of Labor Statistics (BLS) on a monthly basis so that the figures generally come out in the very beginning of the next month. For instance, the November data will be published on the 2 nd of December and the figures for December are published a month later: on the 4 th of January.

The vacancies are calculated by the BLS on the base of business surveys. This contrasts to the unemployment for which BLS takes the centralized data, thus resulting in much faster data processing and very quick calculation.

Figure 1

Since these two figures are related the unemployment statistic can often help in forecasting a slower vacancies figure. This is why the vacancies statistic is less meaningful for investors.

This had been the case before the pandemic. Now the vacancies play its own, independent role. The massive monetary help led to the spike in corporate profits and let companies open huge number of new vacancies which overheated the US labor market. The unemployment plunged back to a 3.5% area. However, this figure says little about the state of the labor market. The 3.5% level was typical of the 2018—2019 period when nobody pointed out the labor imbalance.

The vacancies statistic is much more dramatic: the number of job openings doubled compared to the pre-covid situation. US firms are willing to hire twice as many workers than there are in the country.

In a normal situation, the unemployment rate of 3.5%—4% roughly corresponds to 3.5%—4% of open vacancies (Figure 1). Now, that the unemployment is near its historical low, the vacancies is becoming a self-sustaining important figure.

The Fed uses vacancies-to-unemployment (V/U) ratio as a basic gauge for assessing the influence of the labor market on inflation. The falling V/U ratio does not necessarily mean that the unemployment is going to rise. Once the vacancies rose without the fall in the unemployment, why couldn’t it fall without causing the unemployment to rise?

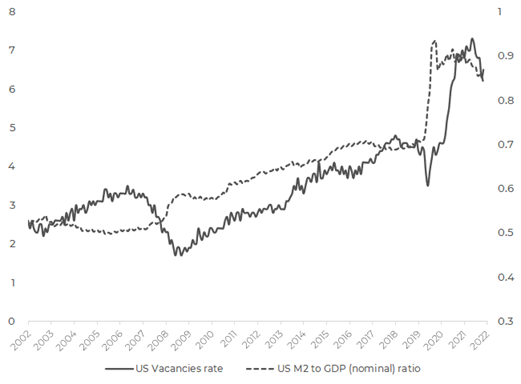

Figure 2 .

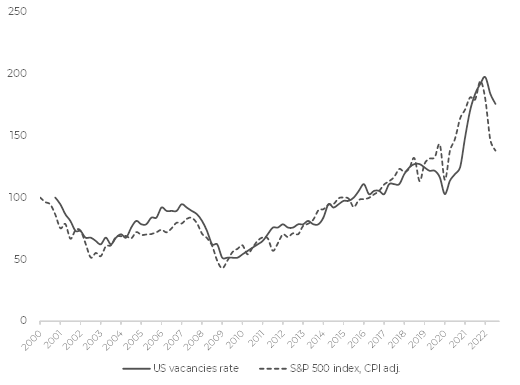

Figure 2 demonstrates the relationship between open vacancies and the monetary excess in the economy. High base rate does not let the monetary mass expand. Moreover, it has been declining since March. Growing nominal GDP is sending the (M2/GDP) ratio downwards easing the monetary pressure. Common sense tells us that the vacancies should follow.

Declining vacancies rate is vitally important for keeping control over the inflation. High vacancies rate makes workers confident over their spendings and give them bargaining power in talks with employers [2] .

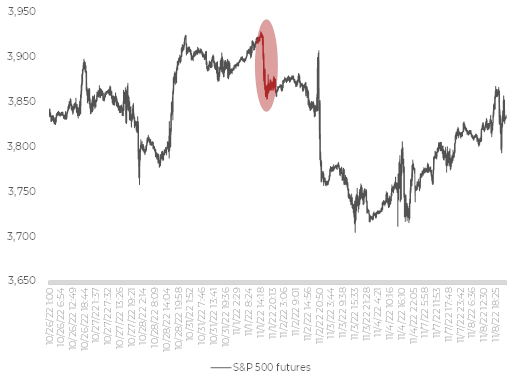

The September figure came out on the 1 st of November at 10’717k new vacancies on the back of the market estimations at 9’750k [3] .

Figure 3 demonstrates the equity market reaction to this negative surprise.

Figure 3 . S&P 500 futures, intraday chart

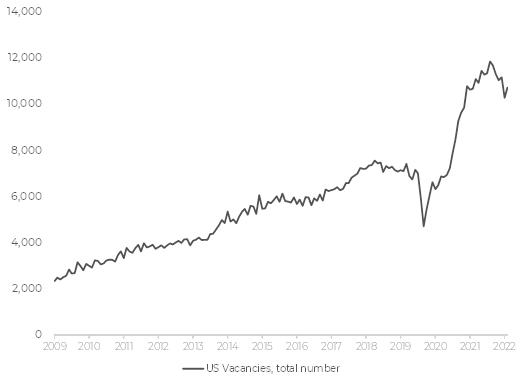

Figure 4 .

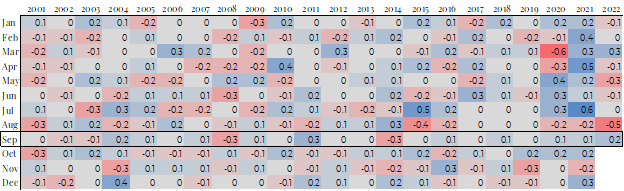

However, it looks like investors are ignoring the cyclical nature of the vacancies’ statistic. It has clear monthly fluctuations (Figure 4). The larger a fluctuation is, the stronger the opposite move in the next month follows. Therefore, the September uptick should not be surprising.

Figure 5 .

Moreover, September is the most positive month for the vacancies’ statistic. The drop of September vacancies happened in 2014 (crash of commodities), 2008 (GFC), 2003 and 2002 (2001 recession aftershock). Only once the vacancies decreased after the fall in August: this was in 2008.

So, in case an August reading is negative (it was the case this year) the subsequent September reading is sooner positive.

It is interesting that the real GDP growth forecast for Q4 is at its highest in 2022: 4.3% p.a. [4] It accelerates the absorption of the liquidity excess pushing down both the inflation pressure and the vacancies rate.

As such, the fundamental environment is favorable to declining vacancies. The monthly cycles also supportive for the downtrend in the labor market: once having an upswing in September we would expect the downswing in October.

The October unemployment grew from 3.5% to 3.7%. We keep in mind that it has a predictive power for the vacancies.

By contrast, current expectations are very conservative. A month ago, investors expected circa 9’700k new vacancies, about 10’700k came out, so now they are expecting around 10’300k. Apparently, the September surprise has made investors very cautious. In our view, summing all the factors, we would expect the drop in vacancies of at least the same magnitude as we had in August when the vacancies slid by 890k in absolute terms. Such a movement drags the open vacancies figure below 10’000k.

P.S.

The chart below looks intriguing, in our view. We leave it with no comment:

Figure 6.

Summary

The growth of vacancies in September has formed very cautious investors’ expectations for October. It might bring about a positive surprise for the market [5] . In our view, investors underestimate fundamental factors supporting the downtrend in the US open vacancies:

· The acceleration of the real GDP which helps economy absorb the excess of the liquidity.

· High inflation by itself also results in the decrease of monetary pressure.

· The monetary excess correlates with the vacancies rate. Now the monetary excess is falling pressing the vacancies downwards.

· Monthly cycles point to weaker October reading.

· Historic data trend shows that the growth of vacancies is typical of September, so the September data is not relevant in terms of a longer trend.

[1] The latest and prior JOLTS Job Openings rate data is available at https://www.bls.gov/jlt/

[2]

“With this shrinking pool of positions and a growing interest coming from job

seekers, it definitely looks like there’s a little less bargaining power on the

workers’ side,” said Cory Stahle, an economist at Indeed.”.

https://www.ft.com/content/02ab11d2-707f-4c49-930d-1a362ad05345

[3] Estimates – as per Bloomberg® data on Nov 1 st , 2022

[4]

Atlanta Fed GDP forecast as of the 23

rd

of November 2022.

https://www.atlantafed.org/cqer/research/gdpnow

[5] Figures come out 30min before the trading session opens.